The author indicates that his theory - Fritz the Cat

Main menu:

The author indicates that his theory of business cycles is, so far as he knows, new. He says that previous theories of the business cycle, over-

He is particularly concerned to cast doubt on the equilibrium theory of business cycles, saying that theoretically, at most times there must be either over or under consumption, spending, investment, production, and everything else. To assume that an economy will long stand still, let alone at its equilibrium point, is mistaken. The idea that there can be an imbalance between different products is erroneous, and even the idea of over and under production is fraught with difficulties, given that they are “relative to human desires and aversions, and can as a whole overshoot or undershoot the equilibrium mark”. (point 13, pg 339) In fact the author believes that there has never been a case of over production, only the case of too little money for too many goods. While any deviation from equilibrium may disturb the business cycle, which of them have been sufficiently disruptive to explain the great booms and depressions of history?

The author proposes that in all great booms the dominant causal factor is over indebtedness, and that in great depressions there are two dominant causal factors, over indebtedness, and resulting from that, deflation. Over investment, over speculation, and over confidence would be minor problems if not accomplished with borrowed money.

The disturbance of over indebtedness and of the purchasing power of the monetary unit will soon cause disturbances in the other economic variables. “On the other hand, if debt and deflation are absent, other disturbances are powerless to bring on crises comparable in severity to those of 1837, 1873, or 1929-

The author deduces the following chain of events resulting from over indebtedness (point 24, pg 341): (1) Debt liquidation leads to a distress setting and to (2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of the velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worth of business, precipitating bankruptcies and (5) A like fall in profits, which in a “capitalistic”, that is, a private profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to (7) Pessimism and loss of confidence, which in turn lead to (8) Hoarding and slowing down still more the velocity of circulation. The above 8 changes cause (9) Complicated disturbances in the rate of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest. (point 24, pg 341-

When over indebtedness is not followed by deflation, for instance if reflationary practices are put into effect, the resulting disturbance to the business cycle will be much milder than if accompanied by deflation, Likewise, if deflation is not accompanied by over indebtedness, the resulting disturbance will be much milder. It is when the two go together, and feed into each other, that great depressions come about.

In a situation of general over indebtedness, each individual debtor’s efforts to pay his bills by liquidating his assets results in the paradoxical effect of each remaining dollar of debt being harder to pay. When large numbers of people try to liquidate assets at the same time, the laws of supply and demand necessarily decrease the value of the assets, in effect making the unit of currency stronger. This effect is particularly pronounced in commodities, but also effects stocks, bonds, and other financial instruments. If allowed to run its “natural” course, the result would be bankruptcy, mass unemployment, misery, starvation, and revolution.

The chief inducements to these mass epidemics of mass over indebtedness are new inventions, the opening of new markets, infrastructure developments such as canals and railroads, and in general anything that promises a return on capital vastly above the status quo. Low interest rates are a contributing factor, though high interest rates will not slow down over indebtedness if the anticipated rate of return is above the interest rate, as is usually the case.

https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

The U.S. increased the ratio of public and private debt from 152% GDP in 1980 to peak at 296% GDP in 2008, before falling to 279% GDP by Q2 2011. The 2009-

htLast year, the U.S. spent $430 billion on interest payments alone. This means that every year, tax payers are spending $3,500 just on interest payments. This is money that isn’t going to pay for roads, bridges, education, medical research or defense.tps://en.wikipedia.org/wiki/Financial_position_of_the_United_States

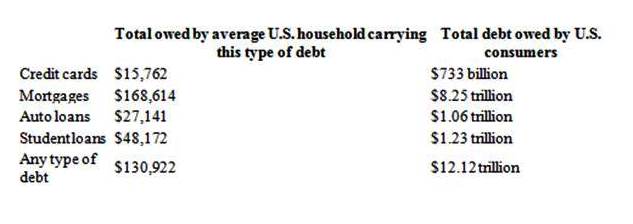

https://www.nerdwallet.com/blog/credit-

Debt balances are current as of Q4 2015; figures are

Why debt has grown: The rise in the cost of living has outpaced income growth over the past 12 years. While

The rise in thThe average household is paying a total of $6,658 in interest per year. [3] This is 9% of the average household income ($75,591) [4] being spent on interest alone. e cost of living has outpaced income growth over the past 12 years.

The author proposes that in all great booms the dominant causal factor is over indebtedness , and that in great depressions there are two dominant causal factors, over indebtedness, and resulting from that https://fraser.stlouisfed.org/docs/meltzer/fisdeb33.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/11882915/Deflation-

By Ambrose Evans-

9:46PM BST 23 Sep 2015

Workers of the world are about to get their revenge. Owners of capital will have to make do with a shrinking slice of the cake.

The powerful social forces that have flooded the global economy with abundant labour for the past four decades years are reversing suddenly, spelling the end of the deflationary super-

"We are at a sharp inflexion point," says Charles Goodhart, a professor at the London School of Economics and a former top official at the Bank of England.

As cheap labour dries up and savings fall, real interest rates will climb from sub-

The implications are ominous for long-

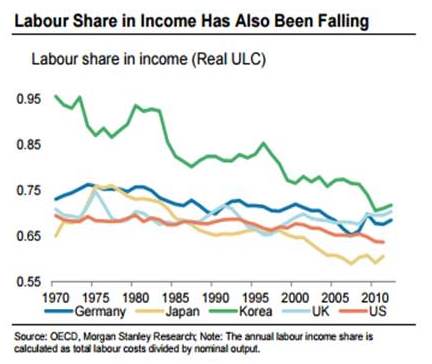

Prof Goodhart says the coming era of labour scarcity will shift the balance of power from employers to workers, pushing up wages. It will roll back the corrosive inequality that has built up within countries across the globe.

If he is right, events will soon discredit the sweeping neo-

Mr Piketty's unlikely bestseller -

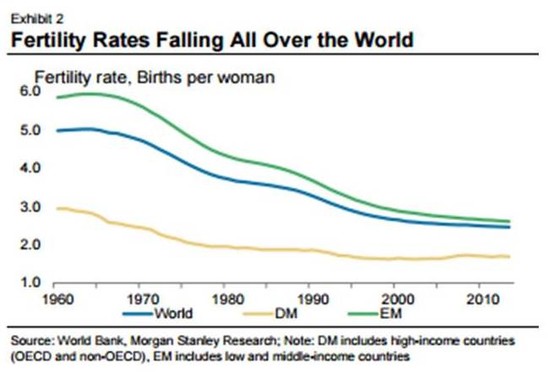

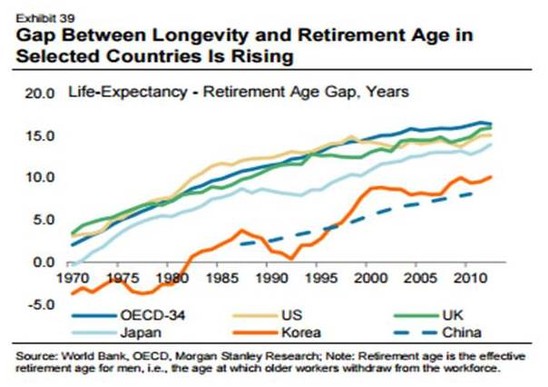

What in reality happened is that the twin effects of plummeting birth rates and longer life spans from 1970 onwards led to a demographic "sweet spot", a one-

Prof Goodhart and Manoj Pradhan argue in a paper for Morgan Stanley that this was made even sweeter by the collapse of the Soviet Union and China's spectacular entry into the global trading system.

The working age cohort was 685m in the developed world in 1990. China and eastern Europe added a further 820m, more than doubling the work pool of the globalised market in the blink of an eye.

"It was the biggest 'positive labour shock' the world has ever seen. It is what led to 25 years of wage stagnation," said Prof Goodhart, speaking at a forum held by Lombard Street Research.

We all know what happened. Multinationals seized on the world's reserve army of cheap leader. Those American companies that did not relocate plant to China itself were able play off Chinese wages against US workers at home, exploiting "labour arbitrage". US corporate profits after tax are now 10pc of GDP, twice their historic average and a post-

It was much the same story in Europe. Volkswagen openly threatened to shift production to Poland in 2004 unless German workers swallowed a wage freeze and longer hours, tantamount to a pay cut. IG Metall bowed bitterly to the inevitable.

Cheap labour held down global costs and prices. China compounded the effect with a factory blitz -

Lulled by low consumer price inflation, central banks let rip with loose money -

This era is now history. Wages in China are no longer cheap after rising at an average rate of 16pc for a decade.

The yuan is overvalued. It has appreciated 22pc in trade-

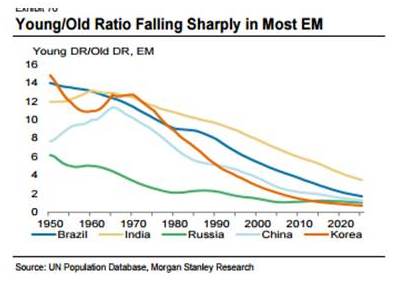

But the underlying causes of the deflationary era run deeper. The world fertility rate has steadily declined to 2.43 births per woman from 4.85 in 1970 , with a precipitous collapse over the past 20 years in east Asia.

The latest estimates are: India (2.5), France (2.1), US (two), UK (1.9), Brazil (1.8), Russia and Canada (1.6), China (1.55), Spain (1.5) Germany, Italy, and Japan (1.4), Poland (1.3) Korea (1.25), and Singapore (0.8). As a rule of thumb, it takes 2.1 to keep the population on an even keel.

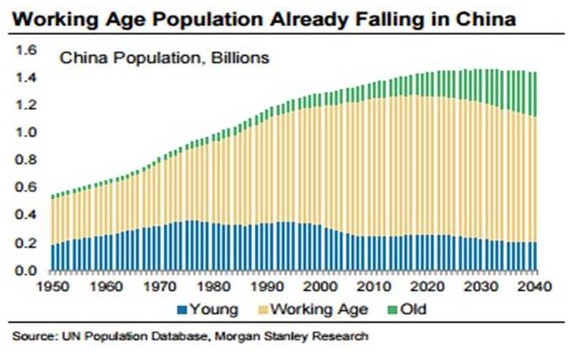

The numbers of working-

"We are on the cusp of a complete reversal. Labour will be in increasingly short supply. Companies have been making pots of money but life isn't going to be so cosy for them anymore," said Prof Goodhart.

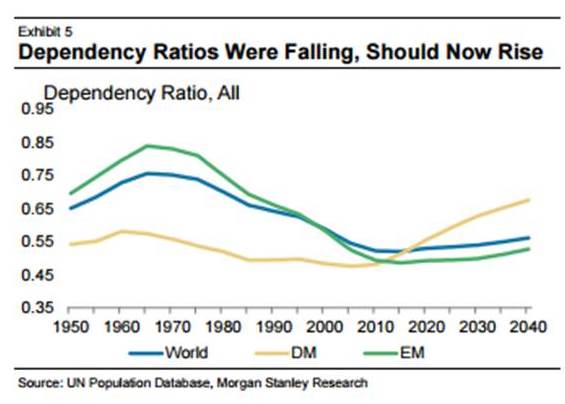

The dependency ratio has already bottomed out in the rich countries. It is now rising far more quickly than it fell as baby boomers retire and people live much longer.

China will face a double hit, thanks to the legacy effects of the one-

It is widely assumed that the demographic crunch will pull the world deeper into deflation, chiefly because that is what has happened to Japan -

The Goodhart paper makes the opposite case. Healthcare and ageing costs will drive fiscal expansion, while scarce labour will set off a bidding war for workers, all spiced by a state of latent social warfare between the generations. "We are going back to an inflationary world," he said.

China will no longer flood the world with excess savings. The elderly will have to draw down on their reserves. Companies will have to invest again in labour-

We will see a reversal of the forces that have pushed the world savings rate to a record 25pc of GDP and created a vast pool of capital spilling into asset booms everywhere, even as the global economy languishes in a trade depression.

The "equilibrium rate" of real interest will return to normal and we can all stop talking about "secular stagnation". Central banks can stop fretting about the horrors of life at the "zero lower bound" (ZLB), and they are certainly fretting right now.

The Bank of England's chief economist, Andrew Haldane, warned in a haunting speech last week that we may be stuck in a zero-

"Central banks may find themselves bumping up against the ZLB constraint on a recurrent basis," he said. His answer is a menu of quantitative easing so exotic it trumps Corbynomics for heterodoxy.

Professor Goodhart makes large assumptions. He doubts that robots will displace workers fast enough to offset the labour shortage, or that greying nations are culturally able to absorb enough immigrants to plug the jobs gap, or that India and Africa have the infrastructure to repeat the "China effect".

The world has never faced an ageing epidemic before so we are in uncharted waters. What is clear is that the near vertical take-

The last time Europe's serfs suddenly found themselves in huge demand was after the Black Death in the mid-

https://www.washingtonpost.com/opinions/the-

American consumers aren’t what they used to be — and that helps explain the plodding economic recovery. It gets no respect despite creating 14 million jobs and lasting almost seven years. The great gripe is that economic growth has been held to about 2 percent a year, well below historical standards. This sluggishness reflects a profound psychological transformation of American shoppers, who have dampened their consumption spending, affecting about two-

This, as much as any campaign proposal, may shape our economic future. There’s an Old Consumer and a New Consumer, divided by the Great Recession. The Old Consumer borrowed eagerly and spent freely. The New Consumer saves soberly and spends prudently. Of course, there are millions of exceptions to these generalizations. Before the recession, not everyone was a credit addict; now, not everyone is a disciplined saver. Still, vast changes in beliefs and habits have occurred.

A Gallup poll shows just how vast. In 2001, Gallup began asking: “Are you the type of person who more enjoys spending money or who more enjoys saving money?” Early responses were almost evenly split; in 2006, 50 percent preferred saving and 45 percent favored spending. After the 2008-

What’s happening is the opposite of the credit boom that caused the financial crisis. Then, Americans skimped on saving and binged on borrowing. This stimulated the economy. Now, the reverse is happening. Americans are repaying old debt, avoiding new debt and saving more. Although consumer spending has hardly collapsed, it provides less stimulus than before. (A conspicuous exception: light-

Consider the personal savings rate: the difference between Americans’ after-

Federal Reserve figures on debt tell a similar story. From 1999 to 2007, household borrowing (mainly home mortgages and credit card debt) increased nearly 10 percent annually, far faster than income gains. People mistakenly believed that they could safely borrow against the inflated values of their homes and stocks. Now, borrowing is subdued. In 2015, household debt of $14 trillion was unchanged from 2007. While many consumers borrowed, others repaid or defaulted.

The surge in saving is the real drag on the economy. It has many causes. “People got a cruel lesson about [the dangers] of debt,” says economist Matthew Shapiro of the University of Michigan. Households also save more to replace the losses suffered on homes and stocks. But much saving is precautionary: Having once assumed that a financial crisis of the 2008-

In theory, it’s easy to replace lost consumer demand. In practice, it’s not so easy. Businesses could build more factories and shopping malls. But with weaker consumer spending, do we need them? More exports would help, but economies abroad are weak.

Opinions newsletter

Thought-

Government policies are also frustrated. The Fed’s low interest rates don’t work if people don’t want to borrow. Ditto for tax cuts. During the Great Recession, Congress enacted several temporary tax cuts to boost consumer spending. The effect was modest, as studies by Shapiro and his collaborators found. Take the case of the two-

Direct government spending (a.k.a. infrastructure) might work better as stimulus. But it, too, faces problems. A mere one-

A bad outcome would be a vicious circle of rising saving and falling returns, leading disappointed households to save even more. Significantly, the McKinsey Global Institute, the consulting company’s research arm, predicts that future returns on stocks and bonds will be lower than in recent years. But it’s also possible, as Shapiro says, that accumulating levels of saving and repaid debt will reassure households and keep their spending growing at a steady, if boring, pace. That wouldn’t be such a bad result.

Whatever happens, the public and politicians should take note: This legacy of the Great Recession will endure. It has left a deep psychological scar that won’t soon heal.